Summary of Exports Policy – 2022

The vision of the policy is to make Odisha a leading state in exports and reach export target of Rs 3.5 Lakh Crore by 2027. The policy aims to achieve this by:

- Vision of the Policy

- Facilitating incremental growth of export of products identified in the focus sectors.

- Promoting product diversification through value addition.

- Promoting initiatives to enhance product quality & standards and support certification of products exported from the State.

- Promoting market diversification with a special focus on access to new markets.

- Promoting skill development and capacity building to improve the competitiveness of the export units.

- Promoting entrepreneurship in the field of exports.

- Facilitate Whole-of-Government approach to improve export competitiveness of the State.

- Focus Sectors

The export promotion initiatives of the State will focus on products and services in the following sectors:

- Mineral & Metals

- Ores, Slag and Ash

- Mineral Fuels, Mineral Oils & Products; Bituminous Substance

- Ceramic Products

- Iron & Steel

- Aluminum& Articles thereof

- Marine

- Fish and Crustaceans, Mollusca, and Other Aquatic Invertebrates

- Preparations of Meat of Fish or of Crustaceans

- Chemical & Allied Product

- Handloom

- Handicraft

- Agriculture

- Horticulture

- Non-Timber Forest Product

- IT & ITeS

- Tourism

- Enhancing Export Related Infrastructure

- Metals & Minerals

- The state will create dedicated MSME Parks/ Industrial Parks with supporting infrastructure to facilitate exports of Ceramic, Iron & Steel, aluminum from downstream units in the state.

- Promote growth of downstream Aluminum and steel exports with a focus on value added products mapped to the following- Aluminum casting, extruded products power cables, precision tools, steel fabrication, food grade steel containers & machinery, Stainless steel pipes.

- Recognizing Exporters

To create a spirit of competitiveness and appreciate the export performance among the exporters of Odisha, “State Export Award” will be organized on annual basis where the following categories of awards shall be given:

- Award for highest foreign exchange earner in the State.

- Award for recording highest YoY growth of exports.

- Award for the best exporter in various sectors including the service sector.

- Award to exporter of new value-added product in the focus sectors.

- Award to exporter to virgin market

- Award to women entrepreneurs in the eld of exports.

- Award to startups in the eld of exports.

- Award to exporting units in additional categories such as promoting innovation, best

- global presence, and adopting best practices (clean manufacturing, adoption of

- new-age packaging techniques etc.)

- Incentives as per Exports Policy – 2022 – Government of Odisha

| Incentive Name | Incentive Particulars | ||||

| Export Development Assistance | Scheme | Eligibility | Details | ||

| International Exhibitions/ Trade fairs taking place in India and Abroad | MSME exporters registered with the concerned DIC/ Merchant exporters having annual turnover of less than Rs. 5 Crore MSME exporters with valid IEC numbers (active or renewed), UAM registration, and/ or Exporters/ Merchants Exporters Having a Valid Passport | The state Govt shall select the product-specific International Trade Fairs/exhibitions for participation based on the inputs received by DGFT and export promotion councils The stall rent for the selected exporters will be borne by the State Government Selected exporters sponsored for participation in the trade fair shall be provided travel expenses in respect of not more than one person for a firm subject to 50% of the total air fare in the economy class limited to 50,00 | |||

| Support to delegations from the state of Odisha to other countries | The delegation comprising representatives from the state Govt and private sector, visiting other countries for trade-related consultations with a similar delegation abroad will be supported by this scheme when such a visit is facilitated/ planned in consultation with Indian diplomatic missions to explore new markets | The delegate shall be provided travel expenses in respect of not more than one person for a firm subject to 50% of the total air fare in the economy class limited to Rs 50,000/- | |||

| Conditions The scheme will be administered by Director, EP&M Exporting company can avail the benefit of one exhibition (international or domestic) and one buyer-seller meet(international or domestic) in one financial year Exporting organizations availing travel support from Govt. of India under a similar scheme shall not be eligible for the above-mentioned state incentives Selection of the exporters for participating in the international Trade fair shall be made by a committee constituted by Govt Any other condition as and when approved under this policy | |||||

| Reimbursement of RCMC Fees/ Charges | Scheme | Eligibility | Details | ||

| A one-time reimbursement of the Registration-Cum-Membership Certificate (RCMC) charges/ fee paid by the first-time exporter to relevant Export Promotion councils Up to Rs 40,000/- | Updated EIC code not more than 02 years old. RCMC fee receipt (with GST invoice) RCMC (Attested Copy) Company & Product Profile (Max 03 Products) | The scheme will be administered by Director, EP&M | |||

| Reimbursement of cost of Organic Certification, Quality Certification | One-time reimbursement shall be available for obtaining organic certification, and quality certification@ 50% of the total outlay subject to a ceiling of Rs.10 lakh. | ||||

| Reimbursement of Cost incurred in obtaining Organic Certification | One-time reimbursement of 50% of the cost incurred in obtaining quality certification for manufacturing processes or any other certification for export (compulsory markings such as Conformity European (CE), China Compulsory Certificates (CCC), etc), issued by any Government agency or any agency authorized by Central or Govt of Odisha, subject to a ceiling of Rs. 50,000. | ||||

| Reimbursement of cost of testing certification | Reimbursement for obtaining testing certification @ 50% of the total cost subject to a ceiling of Rs.10,000/- per export shipment | ||||

| Reimbursement of the cost incurred towards country specific Certification | Reimbursement of the cost incurred by an exporter for the first 3 years towards country specific Certification & Quality Standards for a new product/value-added product, exported to a virgin market @ 50% of the cost incurred towards certification subject to a ceiling of Rs. 10,000/- per export shipment. | ||||

- Major Export Products – Odisha, 2019-20 to 2021-22 (Value INR. crore)

| Products | 2019-20 | 2020-21 | 2021-22 | Share in Value of Exports for 2021-22 (per cent) |

| Metallurgical | 24811.4 | 38122.95 | 86,726.64 | 68.02 |

| Engineering, Chemical and Al-lied | 4434.18 | 7854.68 | 15,496.37 | 12.15 |

| Minerals | 14627.1 | 26189.58 | 19,374.27 | 15.20 |

| Agriculture and Forest | 187.18 | 177.85 | 469.21 | 0.37 |

| Marine | 3028.88 | 3114.16 | 4,462.08 | 3.50 |

| Handloom | 0.9 | 0.09 | 2.02 | 0.00 |

| Handicraft | 3.08 | 7.74 | 9.41 | 0.01 |

| Textile | 131.64 | 205.5 | 930.35 | 0.73 |

| Pharmaceutical | 6.34 | 8.8 | 16.32 | 0.01 |

| Others | 11.62 | 36.97 | 10.99 | 0.01 |

| Total (Merchandise) | 47242.32 | 75718.32 | 1,27,497.66 | – |

| Electronics and software | 4500 | 4701.01 | – | – |

| G Total | 51742.32 | 80419.33 | 1,27,497.66 | 100 |

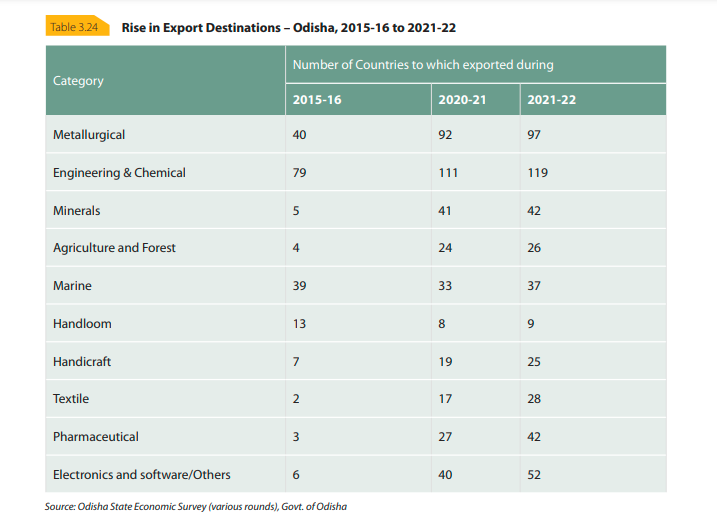

- Rise in Export Destinations – Odisha

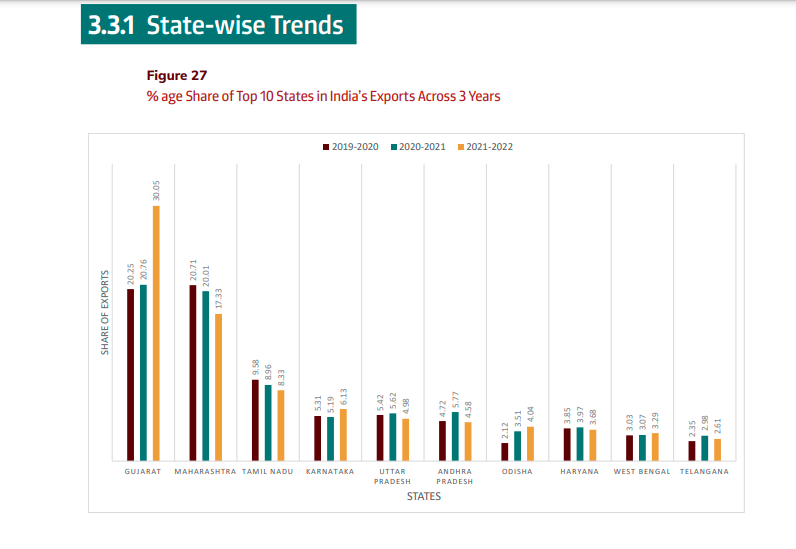

Export Concentration in India’s Top 25 Export Districts

The top 25 districts, in terms of export share, collectively contribute 54 percent of the total exports from the country. Export Concentration is calculated using Herfindahl-Hirschman Index (HHI), which is used to calculate market concentration and competitiveness. A concentrated market has low competitiveness and is therefore, not suited for a healthy economic environment. High value of HHI indicates high concentration of exports to small regions in the country.

- Crucial Incentives from Foreign Trade Policy – 2023, Government of India

Towns of Export Excellence (TEE)

- Objective: Development and growth of export production centres. A number of towns have emerged as dynamic industrial clusters contributing handsomely to India’s exports. It is necessary to grant recognition to these industrial clusters with a view to maximize their potential and enable them to move up the value chain and also to tap new markets.

- Selected towns producing goods of Rs. 750 Crore or more may be notified as TEE based on potential for Legal Framework and Trade Facilitation 7 growth in exports. However, for TEE in Handloom, Handicraft, Agriculture and Fisheries sector, threshold limit would be Rs.150 Crore. The following facilities will be provided to such TEE:

- Recognized associations of units will be provided financial assistance under MAI scheme, on priority basis, for export promotion projects for marketing, capacity building and technological services.

- Common Service Providers in these areas shall be entitled for Authorisation under EPCG scheme.

- As on date, the only notified town (TEE) in the state of Odisha is Bhubaneswar. Certain advocacy initiatives with the state government can also ensure TEE status to Jharsuguda as well, where Vedanta houses Asia’s largest(Ex- China) aluminium smelter.

Status Holder Certification

- The objective behind certifying certain exporter firms as “Status Holder” is to recognize such exporter firms as business leaders who have excelled in international trade and have successfully contributed to country’s foreign trade. Status Holders are expected to not only contribute towards India’s exports but also provide guidance and handholding to new entrepreneurs.

- All exporters of goods, services and technology having an import-export code (IEC) number, on the date of application, shall be eligible for recognition as a status holder based on export performance. An applicant may be categorized as status holder on achieving the threshold export performance in the current and preceding three financial years as indicated in para 1.26 of Foreign Trade Policy. However, for Gems & Jewelry Sector above export performance threshold during the current and preceding two financial years shall be required. The export performance shall be counted on the basis of FOB of export earnings in freely convertible foreign currencies or in Indian Rupees as per para 2.53of the FTP.

- For deemed export, FOR value of exports in Indian Rupees shall be converted in USD at the exchange rate notified by CBIC, as applicable on 1st April of each Financial Year.

- For granting status, an export performance would be necessary in all the three preceding financial years (and in all the two preceding financial years for Gems & Jewelry Sector).

| Status Category | Export Performance Threshold In USD Million |

| One Star Export House | 3 |

| Two Star Export House | 15 |

| Three Star Export House | 50 |

| Four Star Export House | 200 |

| Five Star Export House | 800 |

Grant of Double Weightage

- Double Weightage shall be available for grant of One Star Export House Status category only. Such benefit of double weightage shall not be admissible for grant of status recognition of other categories namely Two Star Export House, Three Star Export House, Four Star export House and Five Star Export House. The exports by IEC holders under the following categories shall be granted double weightage for calculation of export performance for grant of status:

i. Micro and Small Enterprises as defined in Micro, Small & Medium Enterprises Development (MSMED) Act 2006

ii. Manufacturing units having ISO/BIS Certification

iii. Units located in North Eastern States including Sikkim, and Union Territories of Jammu, Kashmir and Ladakh iv. Export of fruits and vegetables falling under Chapters 7 and 8 of ITC HS

- A merchandise shipment/ service rendered can get double weightage only once in any one of above categories.

Privileges of Status Holders

A Status Holder shall be eligible for privileges as under:

- Authorisation and Customs Clearances for both imports and exports may be granted on self-declaration basis;

- Input-Output norms may be fixed on priority within 60 days by the Norms Committee; Special scheme in respect of Input Output Norms to be notified by DGFT from time to time, for specified status holder

- Exemption from furnishing of Bank Guarantee for Schemes under FTP, unless specified otherwise anywhere in FTP or HBP;

- Exemption from compulsory negotiation of documents through banks. Remittance / receipts, however, would be received through banking channels;

- Two star and above Export houses shall be permitted to establish Export Warehouses as per Department of Revenue guidelines.

- The status holders would be entitled to preferential treatment and priority in handling of their consignments by the concerned agencies.

- Manufacturers who are also status holders (Three Star/Four Star/Five Star) will be enabled to self-certify their manufactured goods (as per their IEM/IL/LOI) as originating from India with a view to qualify for preferential treatment under different preferential trading agreements (PTA), Free Trade Agreements (FTAs), Comprehensive Economic Cooperation Agreements (CECA) and Comprehensive Economic Partnership Agreements (CEPA). Subsequently, the scheme may be extended to remaining Status Holders. Manufacturer exporters who are also Status Holders shall be eligible to self-certify their goods as originating from India as per Para 2.93 (e) of Hand Book of Procedures.

- Status holders shall be entitled to export freely exportable items (excluding Gems and Jewelry, Articles of Gold and precious metals) on free of cost basis for export promotion subject to an annual limit of Rupees One Crore or 2% of average annual export realization during preceding three licensing years, whichever is lower. For export of pharma products by pharmaceutical companies, the annual limit would be 2% of the average annual export realisation during the preceding three licensing years. In case of supplies of pharmaceutical products, vaccines and lifesaving drugs to health programmes of international agencies such as UN, WHO-PAHO and Government health programmes, the annual limit shall be upto 8% of the average annual export realisation during preceding three licensing years. Such free of cost supplies shall not be entitled to Duty Drawback or any other export incentive under any export promotion scheme.